STOP THE BLEEDING

The Only Automated Shield Against Bank Disputes & Chargebacks.

Our platform offers comprehensive tools and resources to help businesses effectively navigate and resolve bank disputes, ensuring smoother financial operations and improved customer satisfaction.

Stop Revenue Loss with Sentinel

A Symbol of Defense

Orange is Tactical Urgency

We move fast, we fight smart, and we don’t fold under pressure. It’s not passive protection—it’s proactive defense.

Black Dollar Sign: Authority Over Revenue

The black dollar sign represents earned income that’s non-negotiable. Revenue earned is revenue kept.

How the Shield Defends Merchants

Strategic Protection

Fraud Detection

Flags suspicious behavior before it escalates.

Dispute Intelligence

When a consumer initiates a chargeback. your shield doesn’t just react—it prepares. We arm merchants with airtight documentation, timestamped evidence, and dispute narratives that flip the burden of proof.

Revenue Lock-In

Funds are tagged, tracked, and protected through smart routing and reserve management. We ensure merchants retain access to their capital—even during processor volatility. This isn’t just protection, it’s operational sovereignty.

Simplified Chargeback Management

How Sentinel Solves This Problem - The Dispute Crisis Is Getting Worse

How Sentinel Solves This Problem The Dispute Crisis Is Getting Worse — Sentinel Is Built to Stop It at the Source

As customer behavior shifts toward “dispute‑first” actions and banks continue automating refunds, merchants need far more than a support team or a CRM note. They need a true defense system — one that protects revenue, stabilizes operations, and prevents disputes from ever becoming chargebacks. This is exactly what Sentinel was engineered to do. Sentinel is not a tool. It’s not software. It’s not a dashboard.

Sentinel is a revenue‑recovery engine designed to protect merchants from the new era of consumer disputes.

1. Sentinel Intercepts Disputes Before They Become Chargebacks Banks are now auto‑refunding transactions through systems like RDR and pre‑dispute flows. Sentinel steps in before those automated losses occur. It detects disputes in real time, pulls the transaction into its defense engine, builds a complete evidence package, and submits it instantly — preventing the auto‑refund from triggering. This alone saves merchants millions in lost revenue.

2. Sentinel Turns a 6‑Week Process Into a 6‑Minute Response Traditional dispute handling is slow, manual, and reactive. By the time a merchant responds, the bank has often already sided with the customer. Sentinel flips the script. Using advanced automation and proprietary logic, it analyzes the dispute, identifies the winning strategy, generates the evidence, and submits the case — all in minutes. Speed wins, and Sentinel delivers it.

3. Sentinel Achieves Win Rates Above 70% — Even in High‑Risk Verticals Most merchants lose disputes because they submit weak evidence, miss deadlines, misunderstand issuer logic, or simply don’t know what banks are actually looking for. Sentinel does. With a win rate exceeding 70%, Sentinel consistently outperforms internal teams, processors, and third‑party services. Every win is revenue recovered — revenue that would have been lost forever.

4. Sentinel Reduces Dispute Volume at the Source Winning disputes is powerful, but preventing them is even better. Sentinel identifies problematic funnels, high‑risk SKUs, fraud‑heavy customer segments, issuer patterns, and subscription churn triggers. It then provides actionable insights to reduce disputes before they happen. This lowers ratios, protects merchant accounts, and stabilizes cash flow.

5. Sentinel Protects Merchants From RDR and Auto‑Refund Systems RDR and similar systems are designed to refund first and ask questions never. Sentinel protects merchants by intercepting cases before RDR triggers, challenging disputes that would have been auto‑refunded, reducing the dispute volume that leads to RDR warnings, and providing early alerts when ratios approach danger levels. RDR is a silent revenue killer — Sentinel neutralizes it.

6. Sentinel Shields Your Merchant Account From Monitoring Programs High dispute ratios lead to Visa monitoring, Mastercard monitoring, fines, reserves, and even processor shutdowns. Sentinel’s combination of prevention, rapid response, and high win rates keeps merchants below critical thresholds. This protects your merchant account, your processing stability, and your ability to scale. Sentinel doesn’t just save money — it protects the entire business.

7. Sentinel Protects Your Marketing Spend, Commissions, and Cash Flow Every dispute affects far more than the transaction itself. It impacts the ad spend used to acquire the customer, the commissions already paid to sales reps, the cost of goods, the operational overhead, and the cash flow forecast. Sentinel recovers revenue that keeps your unit economics intact. This is the difference between scaling confidently and scaling recklessly.

8. Sentinel Gives Operators Back Their Time Disputes drain internal teams across customer service, finance, operations, sales, and compliance. Sentinel automates the entire process, freeing your team to focus on growth instead of paperwork. Your staff stops fighting fires — Sentinel handles the battlefield.

The Bottom Line: Sentinel Is the Merchant’s Defense System for 2026 The dispute landscape has changed.

Consumer behavior has changed. Bank automation has changed. But most merchants haven’t. Sentinel is the upgrade — the protection layer — the revenue shield that modern businesses need to survive and scale in a dispute‑heavy environment. It stops auto‑refunds, wins more disputes, reduces dispute volume, protects merchant accounts, preserves marketing ROI, stabilizes cash flow, and defends revenue at scale.

Sentinel doesn’t just solve the dispute problem. It eliminates it.

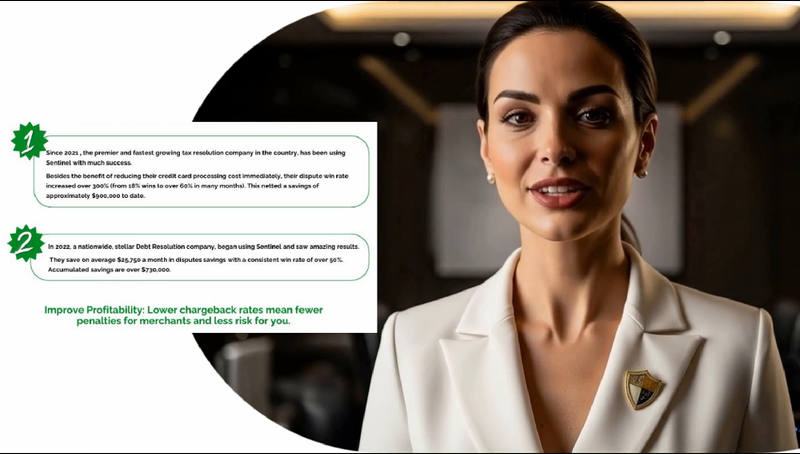

Real Results: $900,000 Saved

SUCCESS WITH SENTINEL: PROVEN ROI

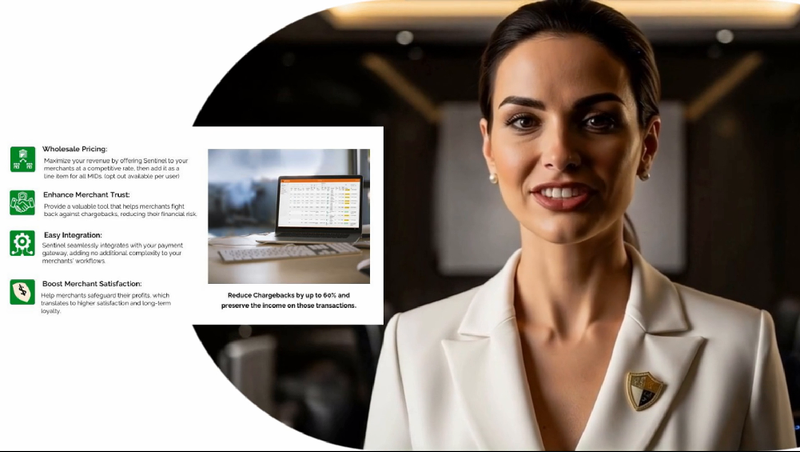

Wholesale Pricing

For Todays Largest Processors and ISO's. Add up to $4.00 or more 'per MID' instantly with Sentinel Bank Dispute Software. Please fill out the form below for pricing matrix (min order of 25,000 MIDS)

Sentinel Request Form

- +1-240-877-4310

- Mon-Fri - 9:00-5:00 EST